The Rise Of Innovation Districts

For the past 50 years, the landscape of innovation has been dominated by places like Silicon Valley—suburban corridors of spatially isolated corporate campuses, accessible only by car, with little emphasis on the quality of life or on integrating work, housing, and recreation.

A new complementary urban model is now emerging, giving rise to what we and others are calling “innovation districts.” These districts, by our definition, are geographic areas where leading-edge anchor institutions and companies cluster and connect with start-ups, business incubators, and accelerators.1 They are also physically compact, transit-accessible, and technically wired and offer mixed-use housing, office, and retail.

Innovation districts are the manifestation of mega-trends altering the location preferences of people and firms and, in the process, re-conceiving the very link between economy shaping, place-making, and social networking.

Our most creative institutions, firms, and workers crave proximity so that ideas and knowledge can be transferred more quickly and seamlessly. Our “open innovation” economy rewards collaboration, transforming how buildings and entire districts are designed and spatially arrayed. Our diverse population demands more and better choices of where to live, work, and play, fueling demand for more walkable neighborhoods where housing, jobs, and amenities intermix.

Led by an eclectic group of institutions and leaders, innovation districts are emerging in dozens of cities and metropolitan areas in the United States and abroad and already reflect distinctive typologies and levels of formal planning. Globally, Barcelona, Berlin, London, Medellin, Montreal, Seoul, Stockholm, and Toronto contain examples of evolving districts. In the United States, districts are emerging near anchor institutions in the downtowns and midtowns of cities like Atlanta, Baltimore, Buffalo, Cambridge, Cleveland, Detroit, Houston, Philadelphia, Pittsburgh, St. Louis, and San Diego. They are developing in Boston, Brooklyn, Chicago, Portland, Providence, San Francisco, and Seattle where underutilized areas (particularly older industrial areas) are being re-imagined and remade. Still, others are taking shape in the transformation of traditional exurban science parks like Research Triangle Park in Raleigh-Durham, which are scrambling to keep pace with the preference of their workers and firms for more urbanized, vibrant environments.

Innovation districts have the unique potential to spur productive, inclusive, and sustainable economic development. At a time of sluggish growth, they provide a strong foundation for the creation and expansion of firms and jobs by helping companies, entrepreneurs, universities, researchers, and investors—across sectors and disciplines—co-invent and co-produce new discoveries for the market. At a time of rising social inequality, they offer the prospect of expanding employment and educational opportunities for disadvantaged populations given that many districts are close to low- and moderate-income neighborhoods. And, at a time of inefficient land use, extensive sprawl, and continued environmental degradation, they present the potential for denser residential and employment patterns, the leveraging of mass transit, and the repopulation of urban cores.

The New Geography of Innovation Today, innovation is taking place where people come together, not in isolated spaces.

WHAT THEY ARE

Innovation districts constitute the ultimate mash-up of entrepreneurs and educational institutions, start-ups and schools, mixed-use development and medical innovations, bike-sharing, and bankable investments—all connected by transit, powered by clean energy, wired for digital technology, and fueled by caffeine.

Given the vast distinctions in regional economies, the form and function of innovation districts differ markedly across the United States. Yet all innovation districts contain economic, physical, and networking assets. When these three assets combine with a supportive, risk-taking culture they create an innovation ecosystem—a synergistic relationship between people, firms, and place (the physical geography of the district) that facilitates idea generation and accelerates commercialization.

All innovation districts contain economic, physical, and networking assets.

Economic assets are the firms, institutions, and organizations that drive, cultivate, or support an innovation-rich environment. Economic assets can be separated into three categories:

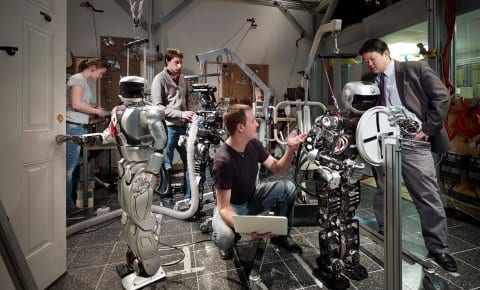

Robots come to life at Drexel University in Philadelphia’s innovation district.

Innovation drivers are the research and medical institutions, the large firms, start-ups, and entrepreneurs focused on developing cutting-edge technologies, products, and services for the market. Due to regional variations in industry strengths, each district is comprised of a unique mix of innovation drivers. Tech-driven industries most likely to be found in Innovation Districts include: high-value, research-oriented sectors such as applied sciences and the burgeoning “app economy”; highly creative fields such as industrial design, graphic arts, media, and architecture; and highly specialized, small batch manufacturing.

Innovation cultivators are the companies, organizations or groups that support the growth of individuals, firms, and their ideas. They include incubators, accelerators, proof-of-concept centers, tech transfer offices, shared working spaces and local high schools, job training firms, and community colleges advancing specific skill sets for the innovation-driven economy.

Coffee shops (like Detroit’s Great Lakes Coffee) are now places for entrepreneurs to work and network.

Neighborhood-building amenities provide important support services to residents and workers in the district. This ranges from medical offices to grocery stores, restaurants, coffee bars, small hotels, and local retail (such as bookstores, clothing stores, and sports shops).

Physical assets are the public and privately owned spaces—buildings, open spaces, streets, and other infrastructure—designed and organized to stimulate new and higher levels of connectivity, collaboration, and innovation. Physical assets can also be divided into three categories:

Physical assets in the public realm are the spaces accessible to the public, such as parks, plazas, and streets that become locales of energy and activity. In innovation districts, public places are created or re-configured to be digitally accessible (with high-speed internet, wireless networks, computers, and digital displays embedded into spaces) and to encourage networking (where spaces encourage “people to crash into one another”). Streets can also be transformed into living labs to flexibly test new innovations, such as in street lighting, waste collection, traffic management solutions, and new digital technologies.

The newly constructed District Hall is the hub for Boston’s Innovation District, facilitating networking and idea-sharing.

Physical assets in the private realm are privately owned buildings and spaces that stimulate innovation in new and creative ways. Office developments are increasingly configured with shared work and lab spaces and smaller, more affordable areas for start-ups. A new form of micro-housing is also emerging, with smaller private apartments that have access to larger public spaces, such as co-working areas, entertainment spaces, and common eating areas.

Physical assets that knit the district together and/or tie it to the broader metropolis are investments aimed at enhancing relationship-building and connectivity. For some districts, knitting together the physical fabric requires remaking the campuses of advanced research institutions to remove fences, walls, and other barriers and replace them with connecting elements such as bike paths, sidewalks, pedestrian-oriented streets, and activated public spaces. Strategies to strengthen connectivity between the district, adjoining neighborhoods, and the broader metropolis include infrastructure investments, such as broadband, transit, and road improvements.

Networking assets are the relationships between actors—such as individuals, firms, and institutions—that have the potential to generate, sharpen, and accelerate the advancement of ideas. “It’s all about programming: choreographing “spontaneous” opportunities for smart people to interact with each other. This is what separates us from traditional science parks.”

–Dennis Lower, CortexNetworks fuel innovation because they strengthen trust and collaboration within and across companies and industry clusters, provide information for new discoveries and help firms acquire resources and enter new markets.

Networks are generally described as either having strong ties or weak ties.5

Strong ties occur between people or firms with a working or professional history that have higher levels of trust, are willing to share more detailed information, and are more apt to participate in joint problem-solving.

Networking assets that build strong ties focus on strengthening relationships within similar fields. These types of assets include: “tech regulars” (where “techies” discuss problems or advances in their work as a collective), workshops and training sessions for specific fields, industry-specific conferences and meetings, and industry-specific blogs for local firms and entrepreneurs.

Weak ties occur between people or firms working within different contexts or economic clusters where there is infrequent contact. Weak ties provide access to new information, new contacts, and business leads outside of existing networks.

Networking assets that build weak ties focus on building new relationships across sectors. Examples include networking breakfasts (where experts and star innovators offer new insights in their fields followed by open time to network), innovation centers, hack-a-thons across industry clusters such as life sciences and tech, tech-jam start-up classes, and even the choreographed open spaces between buildings.

Research indicates that both strong ties and weak ties are fundamental to the innovation process and firm success.

WHERE THEY ARE

Burgeoning innovation districts can be found in dozens of cities and metropolitan areas across the United States. These districts adhere to one of three general models.

The “anchor plus” model, primarily found in the downtowns and mid-towns of central cities, is where large-scale mixed-use development is centered around major anchor institutions and a rich base of related firms, entrepreneurs, and spin-off companies involved in the commercialization of innovation. “Anchor plus” is best exemplified by Kendall Square in Cambridge (and the explosion of growth around MIT and other nearby institutions like Mass. General Hospital) and the Cortex district in St. Louis (flanked by Washington University, Saint Louis University, and Barnes Jewish Hospital).

The “re-imagined urban areas” model, often found near or along historic waterfronts, is where industrial or warehouse districts are undergoing a physical and economic transformation. This change is powered, in part, by transit access, a historic building stock, and their proximity to downtowns in high-rent cities, which is then supplemented with advanced research institutions and anchor companies. This model is best exemplified by the remarkable regeneration underway in Boston’s South Boston waterfront and Seattle’s South Lake Union area.

The third model, “urbanized science park,” commonly found in suburban and exurban areas, is where traditionally isolated, sprawling areas of innovation are urbanizing through increased density and an infusion of new activities (including retail and restaurants) that are mixed as opposed to separate. North Carolina’s Research Triangle Park, perhaps the 20th century’s most iconic research and development campus, is the strongest validation of this model. In November 2012, RTP unveiled a new 50-year master plan that calls for a greater concentration of buildings and amenities, including the creation of a vibrant central district, the addition of up to 1,400 multi-family housing units, retail, and the possible construction of a light rail transit line to connect the park with the larger Raleigh-Durham region.

One of Stockholm’s innovation districts, Stockholm Life, is implementing a bold plan, which includes extending the district over a major highway.

Practitioners in leading-edge innovation districts offer five pieces of advice:

First, build a collaborative leadership network, a collection of leaders from key institutions, firms, and sectors who regularly and formally cooperate on the design, delivery, marketing, and governance of the district. In advanced innovation districts in Barcelona, Eindhoven, St Louis, and Stockholm, leaders found the Triple Helix model of governance to be fundamental to their success.8 The Triple Helix consists of structured interactions between industry, research universities, and government.

Charting a course for this district’s future growth: the Cortex Master Plan in St. Louis.

Second, set a vision for growth by providing actionable guidance for how an innovation district should grow and develop in the short-, medium- and long-term along economic, physical, and social dimensions. Most practitioners cite the importance of developing a vision to leverage their unique strengths—distinct economic clusters, leading local and regional institutions and companies, physical location and design advantages, and other cultural attributes.

Third, pursue talent and technology given that educated and skilled workers and sophisticated infrastructure and systems are the twin drivers of innovation. Pursuing talent requires attraction, retention, and growth strategies; integrating technology requires a commitment to top-notch fiber optics (and, in some places, specialized laboratory facilities) to create a high-quality platform for innovative firms.

Fourth, promote inclusive growth by using the innovation district as a platform to regenerate adjoining distressed neighborhoods as well as create educational, employment, and other opportunities for low-income residents of the city. Strategies in places as disparate as Barcelona, Detroit, and Philadelphia have particularly focused on equipping workers with the skills they need to participate in the innovation economy or other secondary and tertiary jobs generated by innovative growth.

Finally, enhance access to capital to support basic science and applied research; the commercialization of innovation; entrepreneurial start-ups and expansion (including business incubators and accelerators); urban residential, industrial, and commercial real estate (including new collaborative spaces); place-based infrastructure (e.g., energy, utilities, broadband, and transportation); education and training facilities; and intermediaries to steward the innovation ecosystem. Districts in Cambridge, Detroit, and St. Louis have successfully redeployed local capital to meet these needs.

THE PATH FORWARD

The potential for the growth of innovation districts in the United States is exceptionally strong.

Virtually every major city in the United States has an “anchor plus” play given the confluence of a vibrant central business district, a strong midtown area, and transit connecting the two.

Many cities and older suburban communities are also making progress on “re-imagining urban areas,” repositioning underutilized sections of their community through investments in infrastructure (or infrastructure removal), brownfield remediation, waterfront reclamation, and transit-oriented development.

“Innovation districts embody the very essence of cities: an aggregation of talented, driven people, assembled in close quarters, who exchange ideas and knowledge in what urban historian Sir Peter Hall calls a “dynamic process of innovation, imitation, and improvement.” –Peter Hall, Cities in Civilization: Culture, Innovation, and Urban Order

Lastly, a handful of “urbanized science parks” (and their adjacent suburban communities) are clustering development, encouraging density, and creating spaces to allow individuals and firms to network openly.

The rise of innovation districts aligns with the disruptive dynamics of our era and represents a clear path forward for cities and metropolitan areas. Local decision-makers—elected officials and heads of large and small companies, local universities, philanthropies, community colleges, neighborhood councils, and business chambers—would be wise to unleash them. Global companies and financial institutions would be smart to embrace them. States and the federal government should support and accelerate them. The result: a step toward building a stronger, more sustainable, and more inclusive economy in the early decades of this young century.